-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*The USD/JPY hovers near 152.50 as traders adopt a cautious stance before Thursday’s key policy announcement.

*The election of Prime Minister Sanae Takaichi has revived prospects of fiscal expansion and policy easing, boosting the Nikkei 225 to record highs.

*The BoJ Core CPI and Thursday’s rate decision will dictate the Yen’s next move—a dovish hold could weaken it further, while a hawkish surprise may trigger a sharp rebound.

Market Summary:

The Japanese Yen finds itself at a critical crossroads this week as markets await the Bank of Japan’s (BoJ) pivotal rate decision on Thursday. The currency has traded in a relatively subdued range, with USDJPY hovering around 152.50, reflecting a market in a holding pattern ahead of the high-stakes announcement.

Initial market optimism for another rate hike, following the move in January, has been tempered by a significant shift in the political landscape. The election of Sanae Takaichi as Prime Minister has raised concerns that the government may exert influence on the central bank to maintain a more cautious and accommodative policy stance. The sentiment that the BoJ could delay further tightening is powerfully reflected in the equity market, where the Nikkei 225 has rallied to an all-time high, gaining nearly 10% since Takaichi’s election. Investors are betting she will continue the legacy of former Prime Minister Shinzo Abe, favoring substantial government spending and loose monetary settings—a combination that typically weakens the currency while fueling equity gains.

Consequently, the Yen’s near-term fate is intensely data-dependent. Market participants will first scrutinize today’s release of the BoJ Core CPI for clues on domestic price pressures, with all attention then turning to Thursday’s rate decision. The outcome will ultimately determine whether the Yen resumes its weakening trajectory on a reaffirmed dovish stance or stages a recovery on a surprise hawkish shift from the central bank.

Technical Analysis

NIKKEI, H4:

The Nikkei 225 continues to trade with formidable strength within a well-defined uptrend channel, having appreciated more than 30% since the trend’s inception. The rally was initially catalyzed by a large-scale inverse head-and-shoulders reversal pattern that formed at its 2025 low of 30,374, a classic technical structure that often signals a major trend change.

The index’s decisive breach of the critical psychological milestone at the 50,000 mark in the last session underscores the persistent dominance of bullish momentum. This significant breakout suggests that the underlying buying pressure remains robust and increases the probability of a further extension of the current bullish trend.

The sustainability of the advance is supported by a constructive momentum backdrop. The Relative Strength Index (RSI) continues to hover near overbought territory, a condition that can persist during powerful trending moves and reflects strong underlying demand. Concurrently, the Moving Average Convergence Divergence (MACD) maintains its gradual upward trajectory, confirming that bullish momentum remains healthy. While the index is extended in the near term, the combination of the powerful breakout, the established uptrend channel, and confirming momentum indicators paints a convincingly bullish picture for the medium-term outlook.

Resistance Levels: 54,535, 58,800

Support Levels: 45,800, 42,050

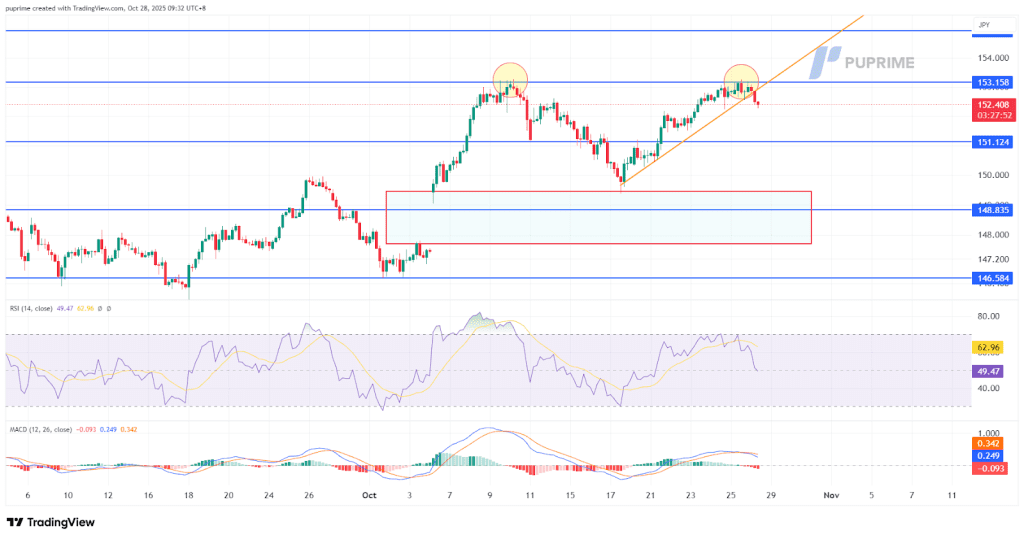

The USDJPY pair is exhibiting clear signs of a bearish reversal, having faced formidable resistance near the 153.20 level where a distinct double-top pattern has formed. This bearish bias is significantly strengthened by a decisive breakdown below the pair’s uptrend support line, confirming a deterioration in the previous bullish structure and signaling a likely shift in sentiment.

The immediate technical trajectory suggests a pullback toward the nearby gap that was established during the prior uptrend. This price imbalance now acts as a primary target for the current downward move, representing a key area where the pair may seek stability.

The bearish perspective is further validated by momentum indicators, which are unanimously pointing to a loss of bullish impetus. The Relative Strength Index (RSI) was notably rejected before reaching overbought territory and has since turned lower. Simultaneously, the Moving Average Convergence Divergence (MACD) has executed a bearish death cross, albeit while remaining above its zero line for now. This confluence of signals indicates that bullish momentum is decisively easing, aligning with the bearish implications of the price action. The path of least resistance appears skewed to the downside, with the gap zone serving as the initial focal point for any potential stabilization.

Resistance Levels: 153.16, 154.95

Support Levels: 151.15, 148.85

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!